Understanding the value of your customers over their lifetime is crucial for any business looking to thrive in today’s competitive market. Customer Lifetime Value (CLV) is a metric that calculates the total revenue a business can expect from a single customer over their lifetime. This metric is vital for businesses to make informed decisions about customer acquisition and retention strategies.

By focusing on increasing CLV, businesses can enhance their profitability and sustainability. It involves understanding customer behavior, preferences, and needs to provide personalized experiences that foster loyalty and encourage repeat business.

Table of Contents

Why is CLV more important than short-term sales?

Customer Lifetime Value (CLV) is more important than short-term sales because it focuses on the long-term profitability of a business rather than just immediate gains. Short-term sales may boost revenue temporarily, but they do not guarantee customer loyalty or repeat purchases. CLV, on the other hand, emphasizes building lasting relationships with customers by delivering consistent value and satisfaction, which leads to repeat business, referrals, and lower marketing costs over time. By prioritizing CLV, companies can develop sustainable growth strategies, improve customer retention, and maximize the return on their investments, ensuring long-term financial stability and competitiveness in the market.

How can businesses increase CLV with simple tactics?

Businesses can increase Customer Lifetime Value (CLV) through simple yet effective tactics that focus on building stronger relationships and encouraging repeat purchases. One key approach is improving customer experience by providing fast, personalized support and making interactions seamless across channels. Loyalty programs and exclusive offers can also encourage repeat business by rewarding customers for their ongoing engagement. Additionally, businesses can use personalized recommendations and targeted communication, such as tailored email campaigns, to make customers feel valued and understood. Finally, collecting feedback and acting on it helps strengthen trust, showing customers that their opinions matter. By consistently delivering value and creating a positive, memorable experience, businesses can turn one-time buyers into long-term, loyal customers who contribute more revenue over time.

Are you truly maximizing the lifetime value of your customers—or are you leaving revenue on the table?

In today’s hyper-competitive market, understanding and increasing Customer Lifetime Value (CLV) is no longer optional—it’s the difference between businesses that thrive and those that merely survive. CLV is more than just a number; it’s a powerful indicator of how much value each customer brings to your business over time. By focusing on CLV, you uncover the keys to sustainable growth: reducing costly churn, improving retention, fostering loyalty, and creating personalized experiences that keep customers coming back.

When businesses optimize for CLV, they spend less on constant customer acquisition and more on building relationships that generate repeat sales, brand advocacy, and long-term profitability. Studies show it can cost up to five times more to acquire a new customer than to retain an existing one—so why not invest in strategies that strengthen loyalty and extend customer relationships? With the right approach, every interaction becomes an opportunity to boost revenue, delight customers, and build a brand that lasts.

At The Spingage, we specialize in helping businesses just like yours turn CLV into a powerful growth engine. From advanced analytics and customer journey optimization to loyalty-building strategies, we give you the tools and insights to transform your customer relationships into long-term success stories.

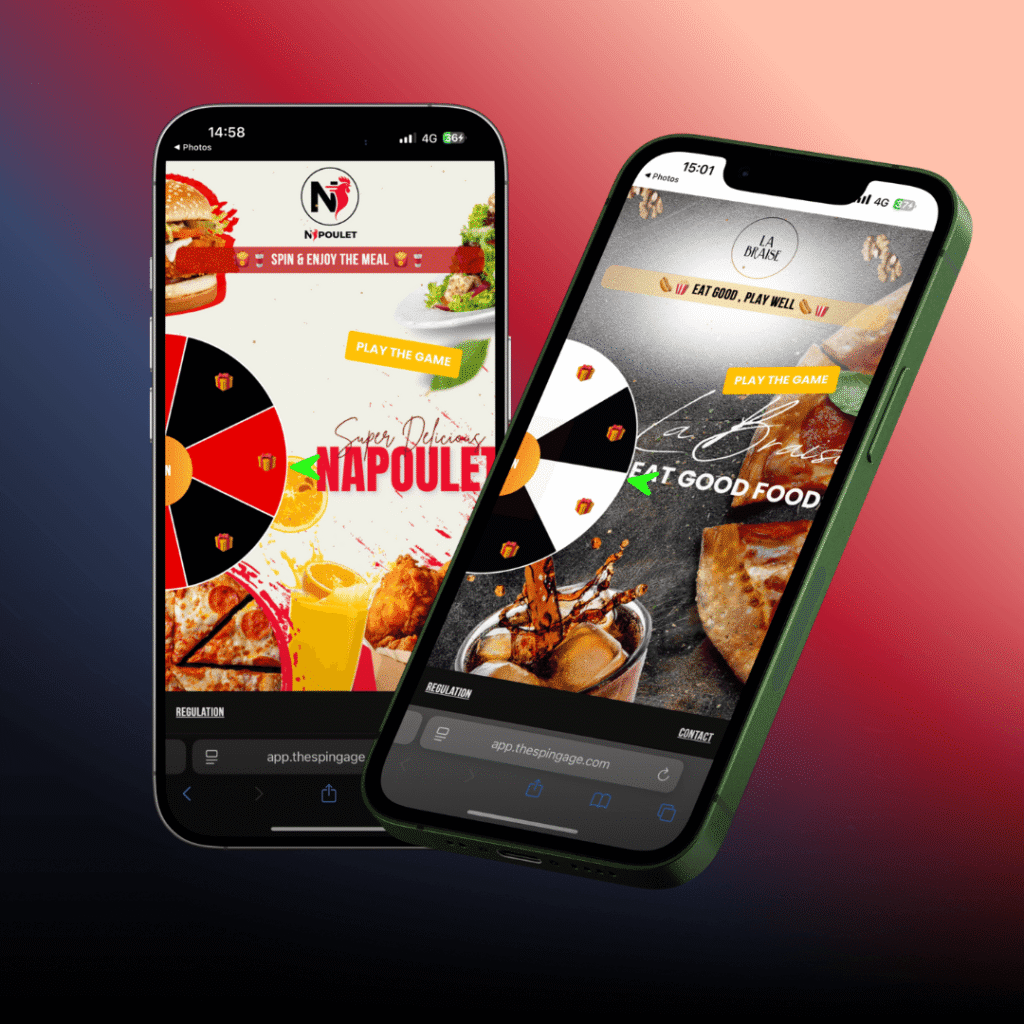

How does SpinGage improve CLV through engagement?

SpinGage improves Customer Lifetime Value (CLV) by driving deeper and more consistent customer engagement. By using interactive and gamified experiences such as spin-to-win campaigns, personalized rewards, and instant gratification mechanics, SpinGage captures customer attention in a way that feels fun and rewarding. This increases participation rates, strengthens emotional connections with the brand, and encourages repeat interactions rather than one-time transactions. As customers engage more frequently, brands gain valuable insights into preferences and behaviors, allowing for more targeted offers and personalized experiences. This combination of higher engagement, stronger loyalty, and smarter personalization leads to increased purchase frequency, larger basket sizes, and ultimately, a measurable boost in CLV.

How does SpinGage automate review collection?

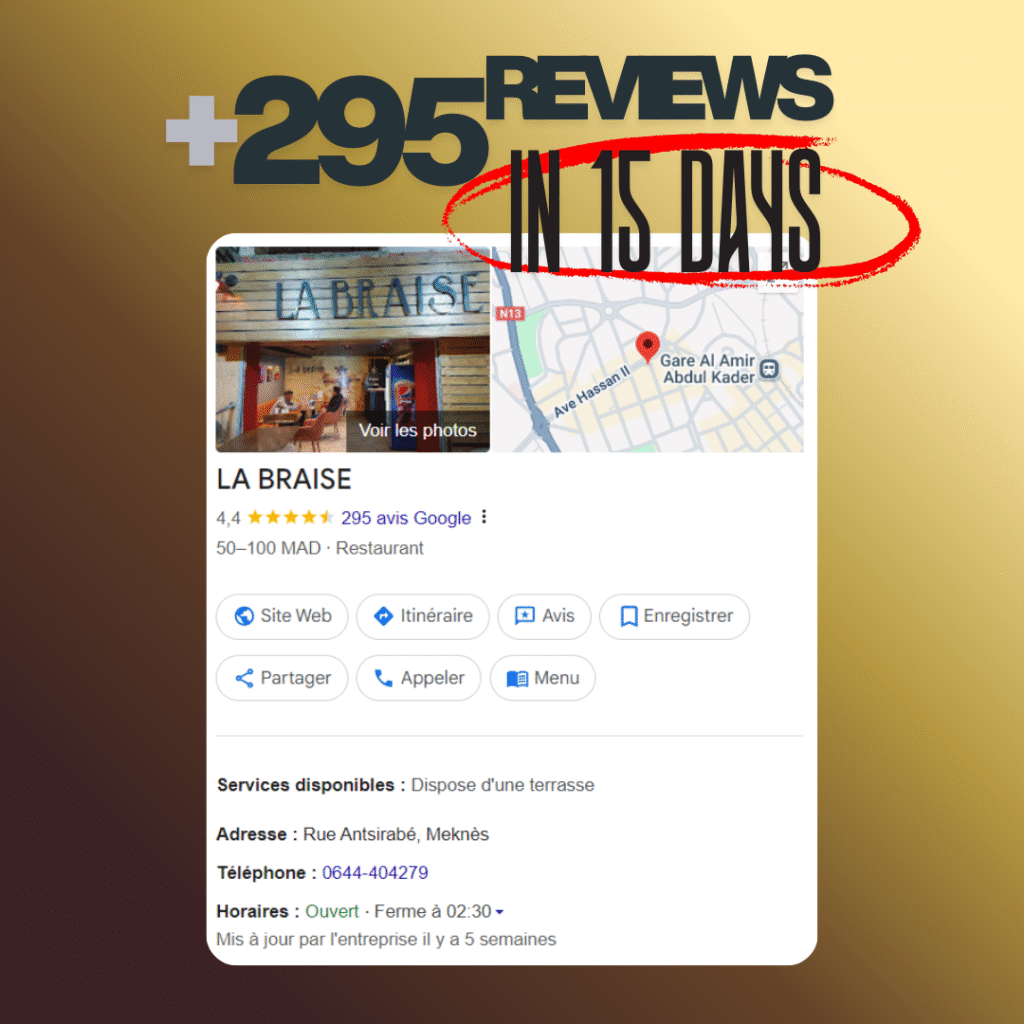

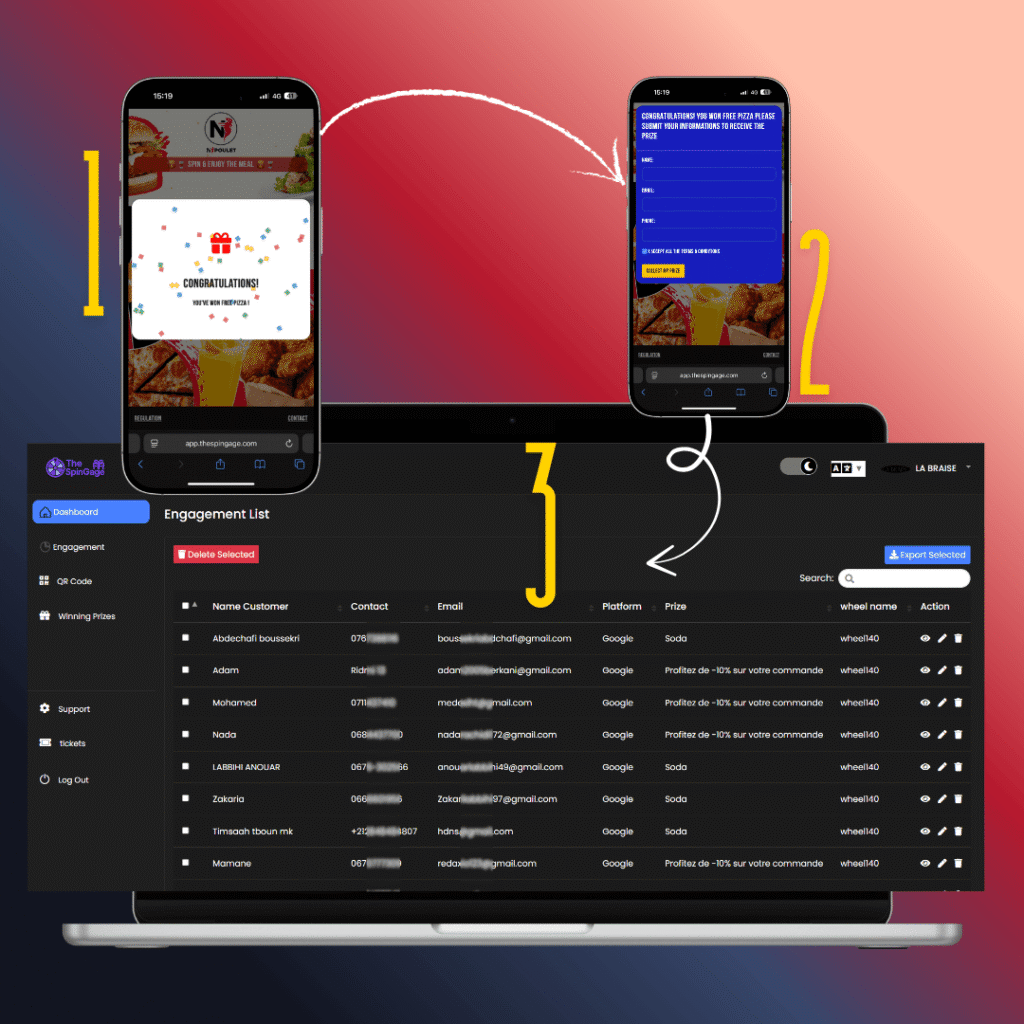

+295 REVIEWS IN JUST 15 DAYS :

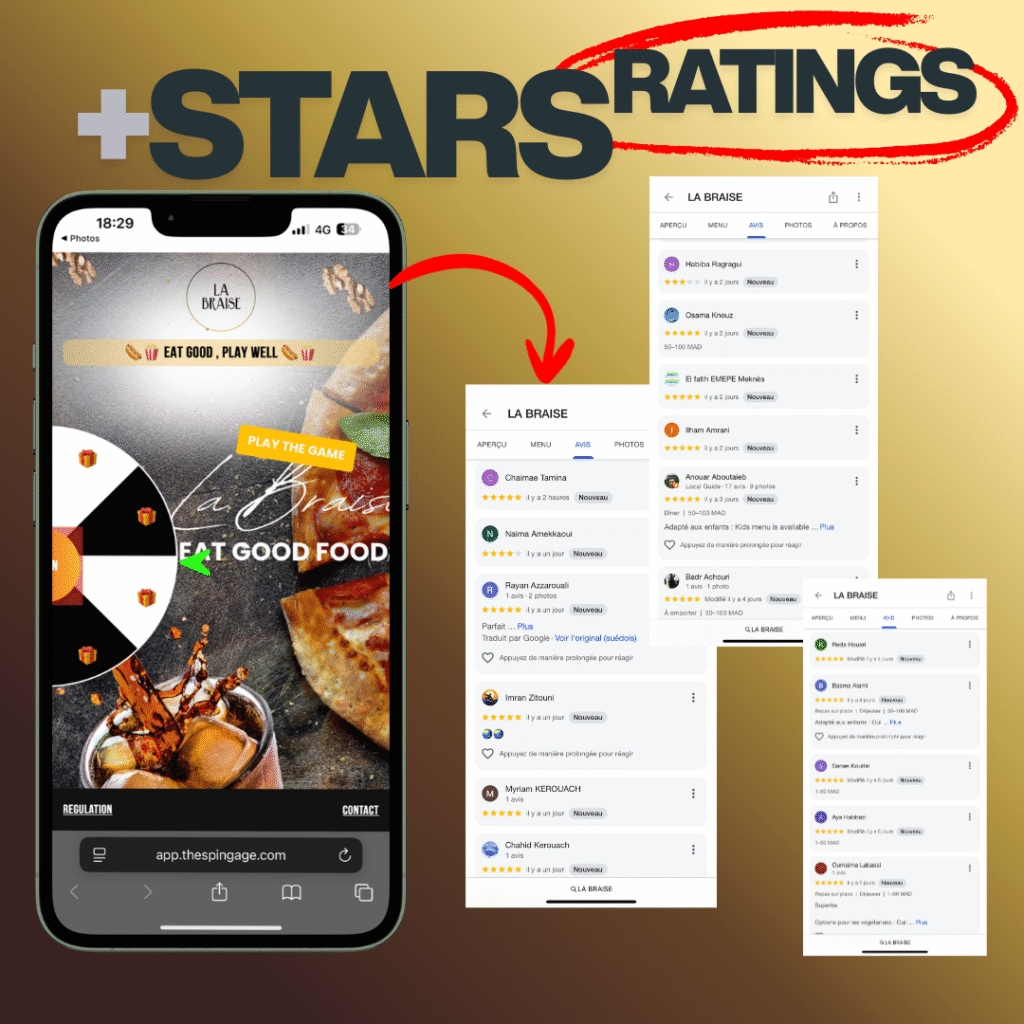

Labraise is a restaurant that gained more than 295 new customer reviews and increased their income by using TheSpinGage solution.

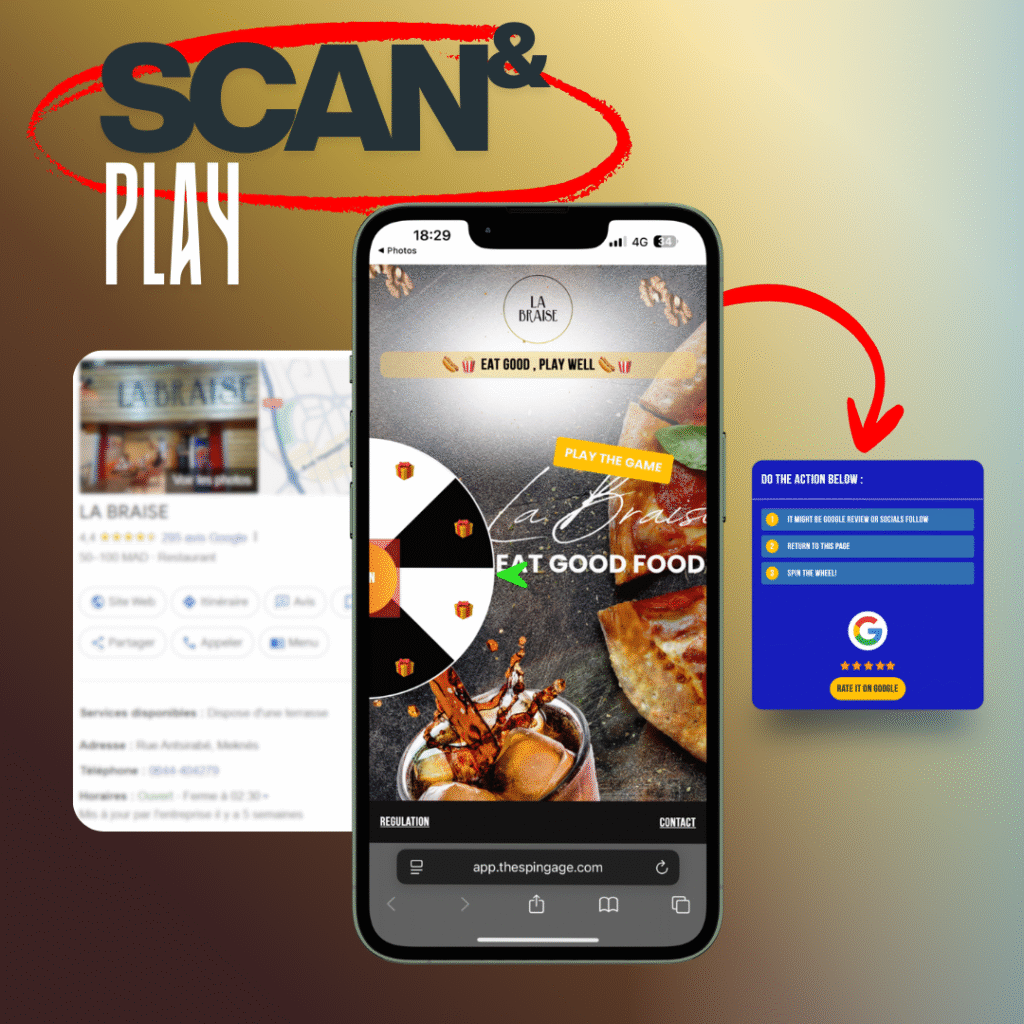

They placed a flyer with a QR code on every table, allowing each diner to scan and spin the wheel. Labraise used a 100% winning ratio plan, where customers always won either 10% off their meal or a free soda.

This simple gamification encouraged guests to leave reviews, boosted loyalty, and kept customers coming back.

HOW IT WORKS IN 4 EASY STEPS ?

1 – Scan the QR Code

Clients simply scan the QR code placed on the table or provided directly by you.

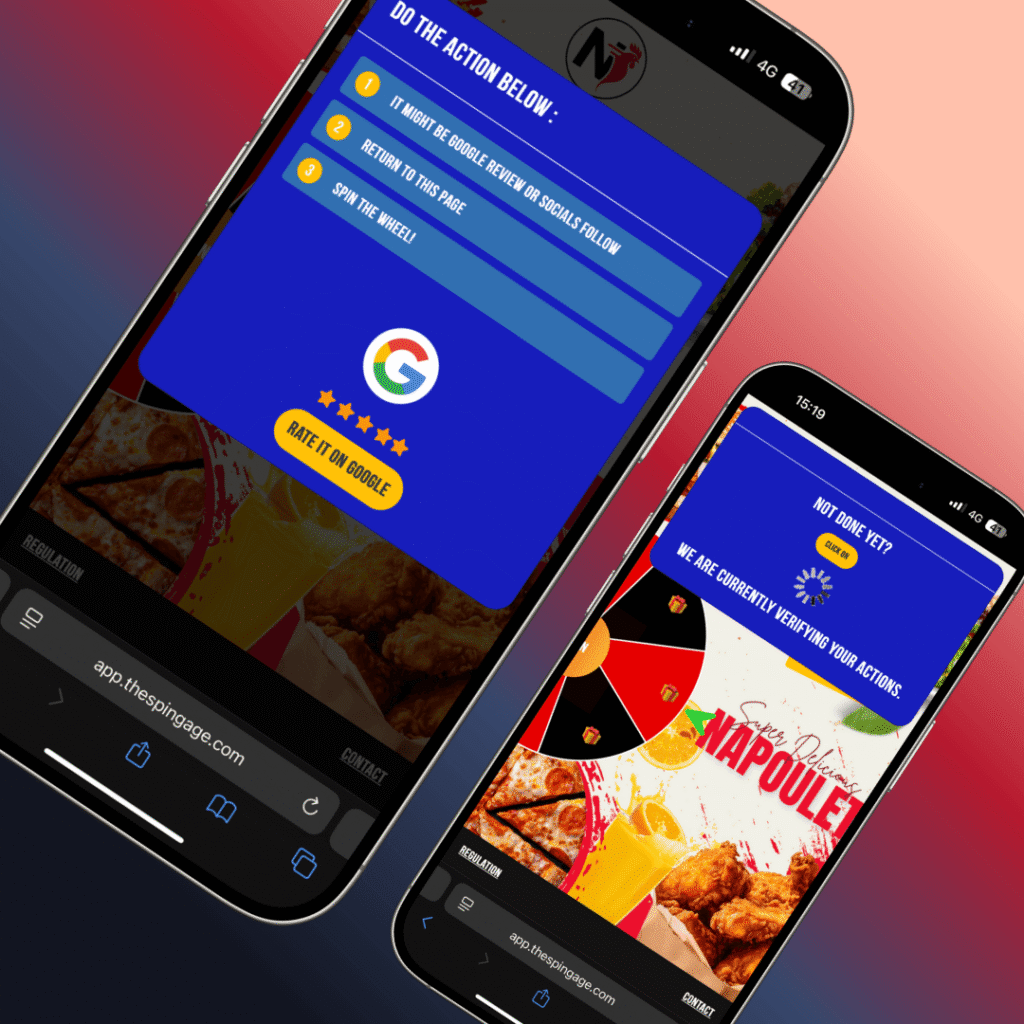

2- Take Action First

To unlock the gameplay, they must complete the required action.

3- Spin the Wheel

Once unlocked, they spin the wheel to test their luck.

4- Win Rewards

If they win, a QR code is instantly sent to their email. If not, nothing happens. In both cases, the game is locked for 24 hours, ensuring fairness and excitement for the next try.

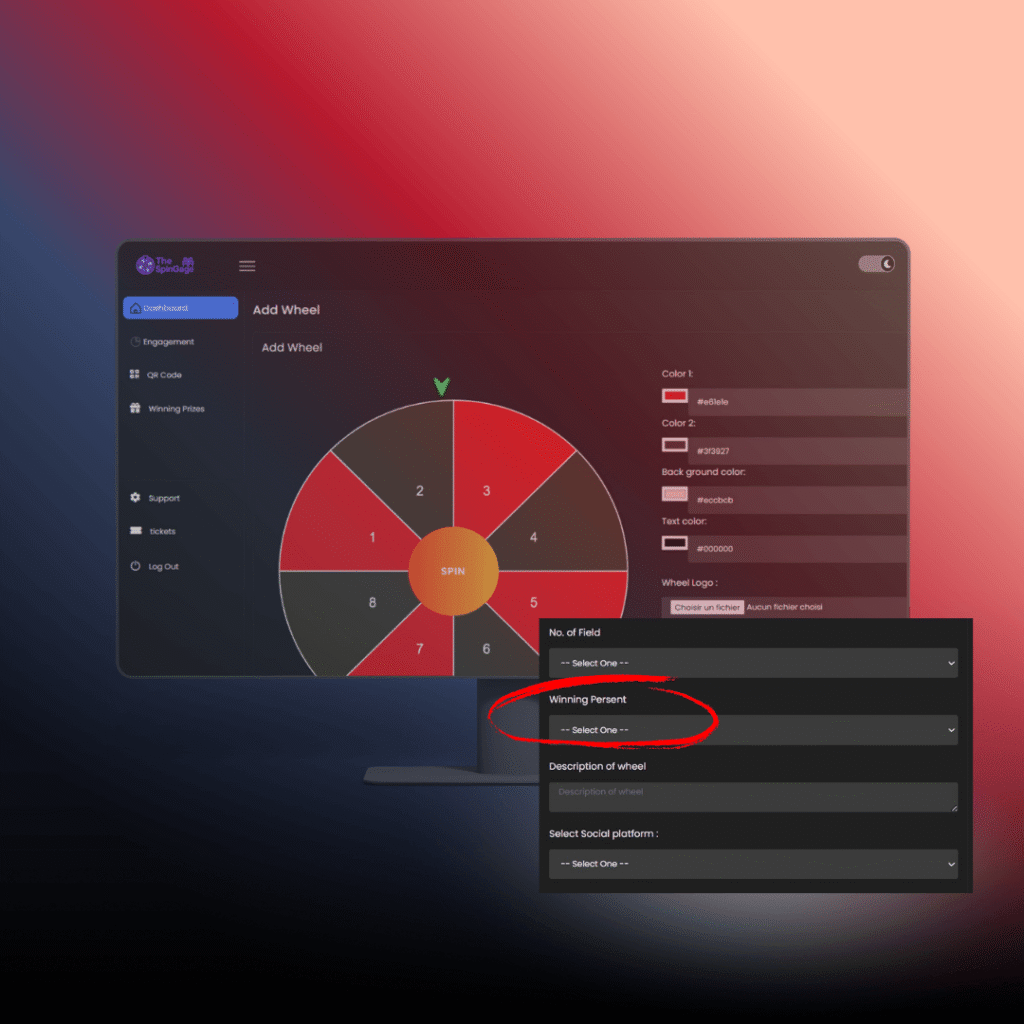

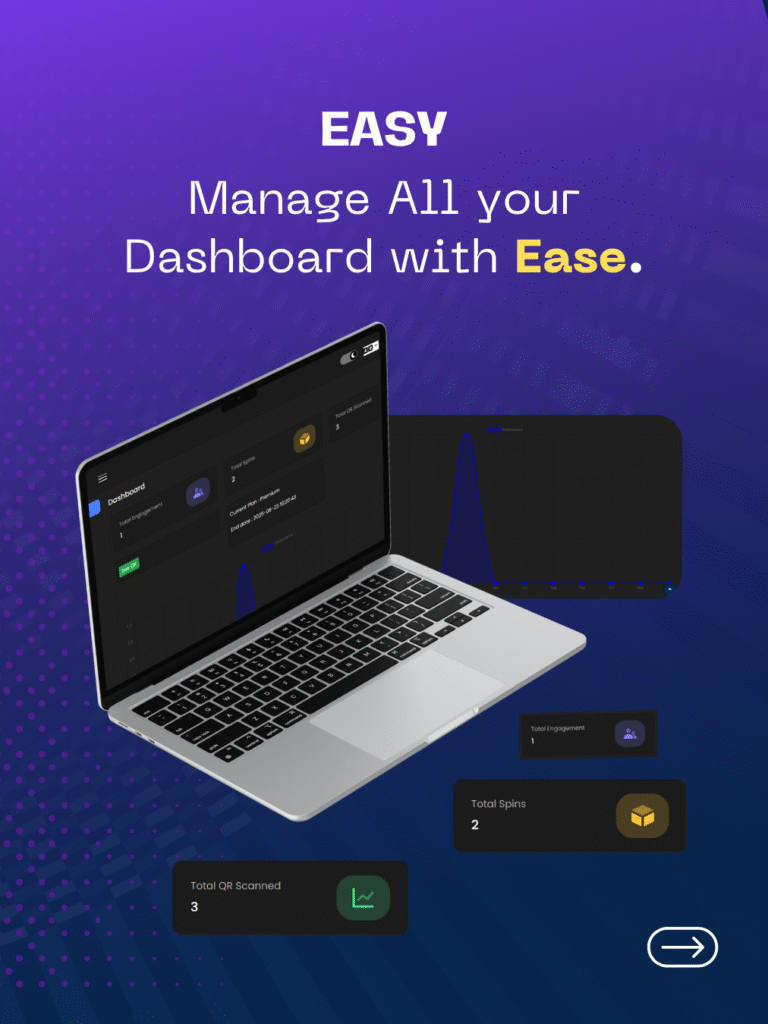

🛠️ Flexible Tracking Options

Track platform Top performing .

Track the wheel segments (number of prizes, Winner Gameplay).

Number of Plays , Track top performing wheel

Set up expiration dates for vouchers and offers.

Get Acces to LEADS , Extraxt & Modiify it .

Why You Should Opt for TheSpinGage Solution

Running a business today is not just about serving customers – it’s about creating memorable experiences that keep them coming back and spreading the word. That’s exactly what TheSpinGage delivers.

🎯 Stand Out from Your Competitors

Most restaurants, cafés, and shops rely only on discounts or word of mouth. With TheSpinGage, you turn every visit into a fun, interactive moment that clients remember and talk about.

⭐ Collect More Positive Reviews

Google reviews are the new “digital reputation.” Our system motivates clients to leave reviews in exchange for a chance to win rewards – giving you the social proof that attracts new clients effortlessly.

💌 Grow Your Customer Database

Every spin is an opportunity to collect emails and data, helping you stay connected with your clients through newsletters, promotions, and loyalty campaigns.

🔄 Boost Loyalty and Repeat Visits

Customers love rewards. By making every visit a chance to win, you encourage repeat visits, turning occasional clients into loyal fans of your business.

⚡ 100% Simple & Automated

No technical headaches. Once installed, TheSpinGage works automatically – whether through QR codes on tables, flyers, or digital screens. You just set the rules, and the system does the rest.

👉 TheSpinGage isn’t just a tool – it’s your new customer magnet.

Increase engagement, grow your reviews, and build a strong database without spending more on ads.

📲 Activate TheSpinGage today and turn visitors into loyal, returning customers!

START TODAY

SpinGage automates review collection by seamlessly integrating with your business platforms to prompt customers for feedback at the right moment. It can automatically send personalized review requests via email or SMS after a purchase or service, making it easy for customers to share their experiences. This automation not only increases the volume of reviews but also ensures consistent and timely feedback, helping businesses maintain a strong online reputation without manual effort.

Combine this with strategic local SEO practices, including keyword research, category optimization, and building citations and backlinks, and you’re positioning your business to dominate local se

👉 Don’t let hidden growth potential slip through your fingers—unlock it today.

Start Growing Smarter with Spingage

What is Customer Lifetime Value (CLV) and Why It Matters

In today’s competitive market, understanding and enhancing Customer Lifetime Value (CLV) is vital for sustainable growth. CLV represents the total value a customer brings to a business over their lifetime, making it a crucial metric for companies aiming to maximize revenue and foster loyalty.

Definition and Basic Concepts

Customer Lifetime Value (CLV) is defined as the present value of all future profits generated by a customer over their lifetime. It encompasses various factors, including purchase frequency, average order value, and customer retention rates. Understanding these components is essential for businesses to develop effective strategies that enhance CLV.

The Business Impact of CLV

The business impact of CLV is significant, as it influences decision-making across various departments. By understanding CLV, businesses can optimize their marketing efforts, improve customer retention, and allocate resources more efficiently. The table below highlights the key benefits of focusing on CLV:

| Benefits | Description | Impact |

|---|---|---|

| Enhanced Customer Retention | Strategies to keep customers engaged | Increased loyalty |

| Optimized Marketing | Targeted campaigns based on CLV insights | Improved ROI |

| Efficient Resource Allocation | Allocating resources based on customer value | Reduced waste and improved efficiency |

By focusing on CLV, businesses can drive long-term growth and profitability. It’s a metric that not only reflects past customer behavior but also predicts future revenue potential.

The Economics Behind Customer Retention vs. Acquisition

In the world of business, the economic dynamics of retaining customers versus acquiring new ones play a pivotal role in determining long-term success. The financial implications of these strategies are significant, and understanding them is crucial for businesses aiming to maximize profitability.

Cost Comparison: Keeping vs. Finding Customers

Acquiring new customers can be expensive. Studies have shown that it can cost five times more to attract a new customer than to retain an existing one. The costs associated with customer acquisition include marketing expenses, promotional offers, and other resources dedicated to attracting new clientele. In contrast, retaining customers typically involves maintaining a good relationship through quality service and engagement, which, while important, generally costs less.

The cost comparison highlights the economic benefits of focusing on customer retention. By reducing churn rates and maintaining a loyal customer base, businesses can significantly lower their overall marketing and operational expenses.

The Loyalty Profit Connection

Loyal customers are not only cheaper to maintain but also more profitable in the long run. They tend to make repeat purchases, refer others, and can become brand advocates. The loyalty profit connection is rooted in the idea that retaining customers leads to increased customer lifetime value (CLV). By fostering loyalty, businesses can create a steady stream of revenue and reduce the pressure on acquiring new customers.

- Increased Repeat Business: Loyal customers are more likely to continue making purchases.

- Positive Word-of-Mouth: Satisfied customers refer others, reducing acquisition costs.

- Brand Advocacy: Loyal customers can become brand advocates, further enhancing the brand’s reputation and attracting new customers.

By understanding and leveraging the economics behind customer retention and acquisition, businesses can make informed decisions that drive profitability and long-term success.

How to Calculate Customer Lifetime Value (CLV)

Accurately determining Customer Lifetime Value (CLV) is essential for businesses to make informed decisions regarding customer acquisition and retention. CLV represents the total value a customer brings to a business over their lifetime.

Basic CLV Formula and Components

The basic CLV formula is calculated as follows: CLV = (Average Order Value x Purchase Frequency) / Customer Churn Rate. The key components include:

- Average Order Value (AOV): The average amount spent by a customer in a single transaction.

- Purchase Frequency: The rate at which customers make repeat purchases.

- Customer Churn Rate: The percentage of customers who stop doing business with a company over a certain period.

Advanced Calculation Methods

For a more nuanced understanding, businesses can employ advanced CLV calculation methods, such as:

- Using historical data to predict future customer behavior.

- Incorporating gross margin into the CLV calculation to account for the profitability of each customer.

Industry-Specific Considerations

Different industries may require adjustments to the basic CLV formula. For instance, subscription-based businesses might focus on the lifetime value of a subscription, while e-commerce businesses might consider the frequency of purchases and average order value.

By understanding and applying these CLV calculation methods, businesses can develop targeted strategies to enhance customer lifetime value.

Key Metrics That Influence Your CLV

Understanding the key metrics that influence Customer Lifetime Value (CLV) is crucial for businesses aiming to maximize their revenue. By focusing on these metrics, companies can develop targeted strategies to enhance customer loyalty and retention, ultimately driving long-term growth.

Purchase Frequency and Average Order Value

Two critical metrics that directly impact CLV are purchase frequency and average order value (AOV). Increasing purchase frequency means customers return more often, while boosting AOV means they spend more per transaction. Strategies such as loyalty programs and personalized marketing can help achieve both.

Customer Churn Rate and Retention Rate

Customer churn rate and retention rate are two sides of the same coin. A lower churn rate indicates higher retention, directly contributing to a higher CLV. Businesses must focus on reducing churn by improving customer satisfaction and engagement.

Customer Satisfaction and Net Promoter Score

Customer satisfaction, often measured by Net Promoter Score (NPS), is a strong indicator of customer loyalty. High NPS scores correlate with higher CLV as satisfied customers are more likely to return and recommend the business to others.

| Metric | Impact on CLV | Strategy to Improve |

|---|---|---|

| Purchase Frequency | Increases CLV | Loyalty Programs |

| Average Order Value | Increases CLV | Personalized Upselling |

| Customer Churn Rate | Decreases CLV | Improved Customer Service |

Creating a Customer-Centric Culture to Boost CLV

Fostering a customer-centric culture is pivotal for businesses aiming to increase Customer Lifetime Value (CLV). This involves a strategic shift in how organizations operate, focusing on delivering value to customers at every touchpoint.

Organizational Alignment Around Customer Value

To achieve a customer-centric culture, organizations must align around customer value. This means:

- Defining Customer Value: Clearly understanding what customers value and how it aligns with business goals.

- Cross-Functional Collaboration: Ensuring departments work together to deliver a seamless customer experience.

Training and Empowering Customer-Facing Teams

Customer-facing teams are crucial in delivering a customer-centric experience. Training these teams to understand customer needs and empowering them to make decisions can significantly enhance customer satisfaction.

Executive Buy-in and Leadership

Securing executive buy-in is vital for driving a customer-centric culture. Leaders must champion this cause, setting the tone for the rest of the organization and ensuring that customer-centric strategies are implemented effectively.

By focusing on these key areas, businesses can cultivate a customer-centric culture that boosts CLV and drives long-term success.

Personalization Strategies That Increase Customer Lifetime Value (CLV)

Personalization strategies are revolutionizing how businesses interact with customers, significantly boosting CLV. By understanding and catering to individual customer preferences, companies can create a more engaging and satisfying experience, leading to increased loyalty and retention.

Data-Driven Customer Segmentation

Effective personalization begins with data-driven customer segmentation. By analyzing customer data, businesses can identify distinct segments based on behavior, preferences, and demographics. This allows for more targeted marketing efforts and tailored experiences that resonate with each segment.

For instance, a study by McKinsey found that companies that use data-driven segmentation see a 10-30% increase in marketing effectiveness.

Tailored Communication and Offers

Once customer segments are identified, businesses can develop tailored communication and offers that speak directly to the needs and interests of each group. This personalized approach not only enhances customer satisfaction but also increases the likelihood of conversion and repeat business.

“The key to successful personalization is understanding your customers and delivering relevant content and offers that meet their needs.” –

Forbes

Creating Memorable Customer Experiences

Creating memorable customer experiences is crucial for building lasting relationships and increasing CLV. This involves not just personalized communication but also ensuring that every touchpoint, from browsing to post-purchase support, is seamless and enjoyable.

Timing and Context in Personalization

The timing and context of personalization efforts can significantly impact their effectiveness. For example, sending a promotional offer at the right moment, such as during a customer’s birthday or after a purchase, can make the customer feel valued and appreciated.

| Personalization Element | Impact on CLV | Example |

|---|---|---|

| Data-Driven Segmentation | Increased marketing effectiveness | Targeted email campaigns |

| Tailored Communication | Enhanced customer satisfaction | Personalized product recommendations |

| Memorable Experiences | Improved customer loyalty | Surprise and delight gestures |

By implementing these personalization strategies, businesses can significantly enhance Customer Lifetime Value, driving long-term growth and profitability.

Loyalty Programs That Actually Work

Loyalty programs can significantly boost customer lifetime value when designed correctly. A well-structured loyalty program not only rewards customers but also fosters a deeper connection between the customer and the brand.

Designing Value-Based Reward Systems

Designing a value-based reward system is crucial for the success of a loyalty program. This involves understanding what customers value most and tailoring rewards accordingly. Personalized rewards can significantly enhance customer satisfaction and encourage repeat business.

- Offer rewards that are relevant to your customers’ preferences.

- Use data analytics to understand customer behavior.

- Implement a tiered system to recognize and reward loyal customers.

Tiered Programs for Long-Term Engagement

Tiered programs are an effective way to promote long-term engagement. By offering different levels of rewards based on customer loyalty, businesses can incentivize customers to continue their relationship with the brand. Tiered programs create a sense of achievement and exclusivity.

- Define clear criteria for each tier.

- Communicate the benefits of each tier clearly to customers.

- Regularly review and adjust tier criteria to keep the program engaging.

Measuring Loyalty Program ROI

Measuring the return on investment (ROI) of a loyalty program is essential to understand its effectiveness. Key metrics include customer retention rates, purchase frequency, and overall revenue generated by loyalty program members. Data analysis tools can help in assessing the program’s impact.

- Track customer retention and churn rates.

- Monitor the redemption rate of rewards.

- Analyze the overall revenue impact.

Leveraging Technology to Enhance CLV

The strategic use of technology can significantly enhance Customer Lifetime Value (CLV) by improving customer engagement and personalization. By adopting the right technological solutions, businesses can foster deeper customer relationships, improve retention, and ultimately drive long-term growth.

CRM Systems and Customer Data Platforms

CRM systems and Customer Data Platforms (CDPs) are crucial for managing and analyzing customer interactions. These technologies help businesses understand customer behavior, preferences, and needs, enabling more effective marketing strategies and improved customer service.

AI and Predictive Analytics for CLV Optimization

AI and predictive analytics play a significant role in optimizing CLV. By analyzing customer data, AI can predict future buying behaviors, identify high-value customers, and personalize marketing efforts to maximize ROI.

| Technology | Function | Benefit |

|---|---|---|

| CRM Systems | Manage customer interactions | Improved customer service |

| AI and Predictive Analytics | Predict customer behavior | Personalized marketing |

| Automation | Streamline customer journeys | Increased efficiency |

Automation for Personalized Customer Journeys

Automation is key to creating personalized customer journeys. By automating routine tasks, businesses can focus on delivering tailored experiences that meet individual customer needs, enhancing overall satisfaction and loyalty.

Case Studies: Companies That Mastered CLV

Through strategic initiatives and innovative approaches, numerous businesses have significantly boosted their CLV, setting new standards in their respective markets. By examining these success stories, we can glean valuable insights into effective CLV strategies.

Retail Success Stories

In the retail sector, companies like Sephora and Starbucks have excelled in enhancing CLV through personalized customer experiences and loyalty programs. Sephora’s Beauty Insider program, for instance, offers tailored rewards and exclusive benefits, encouraging repeat purchases and fostering brand loyalty. Similarly, Starbucks’ loyalty program leverages data-driven insights to provide personalized offers, significantly increasing customer retention.

Subscription-Based Business Examples

Subscription-based businesses, such as Netflix and Spotify, have also seen substantial gains in CLV by focusing on user engagement and personalization. Netflix’s recommendation algorithm, for example, enhances user experience by suggesting content based on viewing history, thereby increasing watch time and reducing churn. Spotify’s Discover Weekly playlist is another example of using data analytics to personalize the user experience, leading to higher customer satisfaction and loyalty.

B2B CLV Transformation

In the B2B space, companies like Salesforce and HubSpot have transformed their CLV by adopting customer-centric strategies and leveraging technology. Salesforce’s use of AI-driven insights to personalize customer interactions has been particularly effective. HubSpot, on the other hand, has focused on providing educational content and support, building strong relationships with its customers and enhancing their lifetime value.

These case studies demonstrate that, regardless of the industry, a focus on CLV can lead to significant business benefits. By understanding and implementing effective CLV strategies, businesses can drive long-term growth and profitability.

Common Mistakes That Hurt Your CLV

Understanding the common mistakes that affect Customer Lifetime Value (CLV) is crucial for sustained business growth. Companies often make errors that can significantly impact their long-term success.

Short-Term Revenue Focus vs. Long-Term Value

Focusing solely on short-term revenue can lead to decisions that undermine long-term customer value. For instance, slashing customer service budgets might boost short-term profits but can harm customer satisfaction and loyalty in the long run.

According to a study by Harvard Business Review, companies that prioritize customer retention over short-term gains tend to outperform their competitors.

“Companies that focus on customer retention are 60% more likely to be successful than those that don’t,”

highlighting the importance of a balanced approach.

Ignoring Customer Feedback and Behavior Signals

Ignoring customer feedback and behavior signals is another critical mistake. Businesses must listen to their customers and adapt to their changing needs. For example, a company that fails to act on customer complaints may lose valuable customers to competitors who are more responsive.

- Monitor customer feedback channels regularly.

- Use data analytics to understand customer behavior.

- Implement changes based on customer insights.

Inconsistent Customer Experience Across Channels

Providing an inconsistent customer experience across different channels can also hurt CLV. Customers expect a seamless experience whether they’re shopping online, in-store, or through a mobile app. Inconsistencies can lead to frustration and drive customers away.

| Channel | Consistency Factor | Impact on CLV |

|---|---|---|

| Online | Uniform branding and messaging | Positive |

| In-Store | Personalized service | Positive |

| Mobile App | Easy navigation and checkout | Positive |

By avoiding these common mistakes, businesses can enhance their Customer Lifetime Value and foster long-term growth.

Conclusion: Building a Sustainable Business Through CLV Focus

Focusing on Customer Lifetime Value (CLV) is crucial for building a sustainable business. By understanding the economics behind customer retention and acquisition, calculating CLV, and implementing strategies to boost it, businesses can drive long-term growth.

A customer-centric culture, personalization, and effective loyalty programs are key to increasing CLV. Leveraging technology, such as CRM systems and AI, can also enhance customer experiences and optimize CLV.

By avoiding common mistakes that hurt CLV, such as a short-term revenue focus and ignoring customer feedback, businesses can maintain a strong CLV focus. This, in turn, contributes to a sustainable business model that prioritizes customer value and drives profitability.

Ultimately, a CLV focus enables businesses to make informed decisions, allocate resources effectively, and build lasting customer relationships, leading to a sustainable business that thrives in the long term.

FAQ

What is Customer Lifetime Value (CLV) and how is it calculated?

Customer Lifetime Value (CLV) is the total value a customer brings to a business over their lifetime. It’s calculated by considering factors like average order value, purchase frequency, and customer lifespan.

Why is CLV important for businesses?

CLV is crucial because it helps businesses understand the long-term value of their customers, making informed decisions about customer retention and acquisition strategies.

How does customer retention compare to customer acquisition in terms of cost?

Retaining customers is generally less expensive than acquiring new ones. The cost of acquiring new customers can be up to five times higher than retaining existing ones.

What role does personalization play in increasing CLV?

Personalization can significantly increase CLV by creating tailored experiences that meet individual customer needs, enhancing customer satisfaction and loyalty.

How can businesses measure the effectiveness of their loyalty programs?

Businesses can measure the effectiveness of their loyalty programs by tracking metrics such as customer retention rates, redemption rates, and overall program ROI.

What are some common mistakes that can hurt CLV?

Common mistakes that can hurt CLV include focusing on short-term revenue, ignoring customer feedback, and providing inconsistent customer experiences across different channels.

How can technology enhance CLV?

Technology, such as CRM systems, customer data platforms, AI, and predictive analytics, can enhance CLV by optimizing customer interactions, improving personalization, and streamlining customer journeys.

What are some key metrics that influence CLV?

Key metrics that influence CLV include purchase frequency, average order value, customer churn rate, retention rate, and customer satisfaction as measured by Net Promoter Score.

Leave a Reply